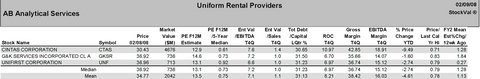

Though I continue to be bearish, I maintain my search for companies whose stocks could buck the trend. One theme that I have suggested is that this recession will not feature the typical job loss of 200K per month, but rather 100k or less. My thinking is that companies have gotten much leaner over the last few years (we ran out of qualified workers!) and that we didn’t have the typical job creation in the recent expansion. I also think that companies in many industries have come to realize how difficult it is to attract and retain great employees. H.R. companies are one way to invest in this theme potentially, but another industry that I have identified as perhaps too pessimistic is the uniform rental delivery industry. There are three publicly traded companies: Cintas (NASDAQ:CTAS) (30.43, $4.7 billion) and the much smaller G&K Services (GKSR) (36.93, $736mm) and UniFirst (NYSE:UNF) (36.96, $713mm). Aramark, which is not a pure-play but is a big player as well, went private a year ago. The companies are very similar, but they differ in terms of some of the other services they offer, the amount of sales rather than rentals and the geographies they serve (domestically as well internationally). As you can see in the 5-year chart below, these three companies have experienced quite different price performance:

click all charts to enlarge

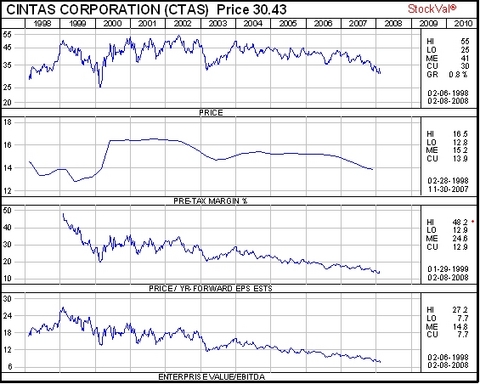

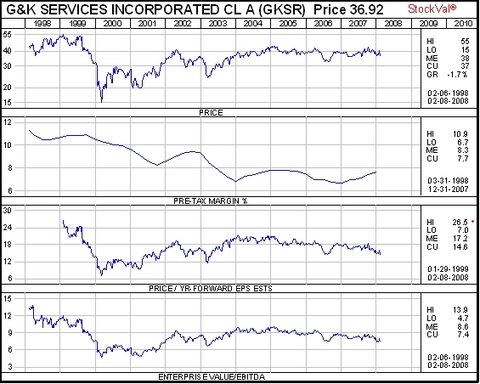

CTAS, the big dog, has been, well, a big dog, especially over the last couple of years as it has moved to an increasingly lower valuation. They have been purchasing stock all the way down too. The company’s scale is evident in its better margin structure. GKSR has been a plodder, while UNF is the one that has performed very well, with the stock reacting to improving margins. As different as the price returns have been, the valuations and balance sheets are remarkably similar at this point:

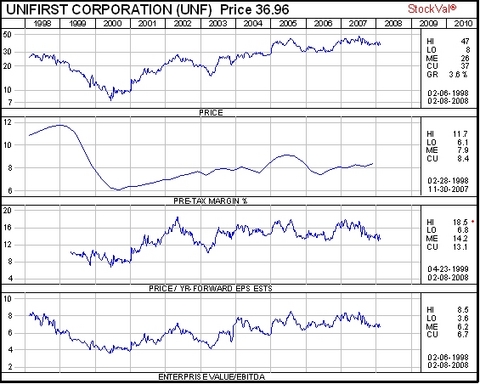

I am just starting to look into this industry and am not sure which company might make the best investment. CTAS certainly has more institutional appeal due to its size. It would also appear to be the one with the most upside if it can revert to the mean. UNF, on the other hand, is the cheapest and still appears to have room to improve its margins. My gut tells me that it is the one that makes the most sense, but maybe G&K improves its margins enough to justify its higher valuation. The industry is one built on consolidation, but potentially GKSR or UNF could be on the receiving end. A few factors that have weighed on the industry for the past few years have been energy costs, difficulty finding drivers in a tight labor market and off-shoring in the manufacturing sector. Several of these factors could reverse or certainly abate in intensity. In the charts below, you can see how generally valuations have declined and margins have been under pressure:

Disclosure: No position in any of these stocks

No comments:

Post a Comment